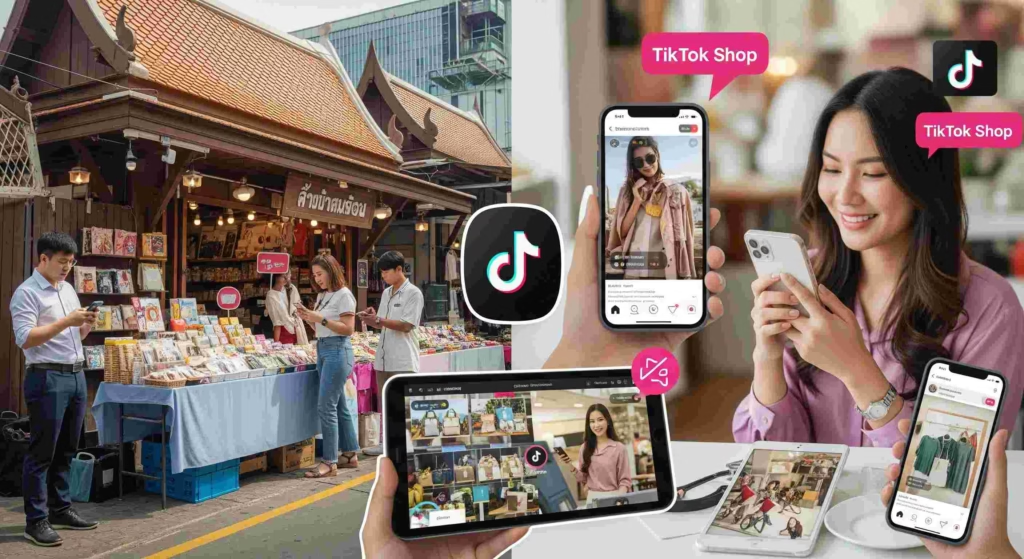

There was a time when TikTok was just for fun—where you’d lose hours watching lip-syncs and life hacks. But today in Thailand, the platform is rewriting the rules of online shopping. And not everyone is winning.

The Rise That Wasn’t Just Viral

TikTok didn’t set out to be a shopping mall, but it became one anyway. By drawing in millions of users through short videos, it created the perfect storm: attention meets accessibility. With commerce tools now deeply integrated into the app, users don’t just scroll, they shop. This strategy has given TikTok a serious advantage over platforms like Lazada and Shopee, whose user engagement hasn’t kept pace (The Nation).

The strength of TikTok lies in its implementation of affiliate marketing. Daily creators generate commissions by endorsing products, providing brands with immediate exposure without requiring large advertising budgets. At first glance, this appears to be a victory. But dig deeper, and cracks start to show.

The Cost of Convenience

Many small Thai sellers now find themselves locked into a system they can’t afford to leave. Pawoot Pongvitayapanu, CEO of Pay Solutions and a long-time advocate for local digital businesses, explained that sellers are barely making ends meet after paying for platform fees, ads, and commissions. “Numerous vendors are currently earning minimal to no profit,” he warned (The Star).

For small business owners, particularly those who previously succeeded on local platforms or physical stores, TikTok’s regulations may seem more like barriers than opportunities.

You either adapt—or you disappear.

When Logistics Are No Longer Local

Beyond sales, even Thailand’s delivery landscape is shifting. TikTok has formed a close alliance with Global Jet Express Thailand (J&T Express), a move that’s sidelining national services like Thailand Post. It’s unclear whether pricing, logistics scale, or international backing drove this decision, but the fallout is clear: local delivery firms are losing relevance (The Nation).

What happens when both the selling and the shipping are no longer rooted in the country?

Selling Out Local Sellers

Another worry is product origin. TikTok’s algorithms and commission systems heavily promote Chinese-made goods. Influencers are rewarded for pushing these products, making it harder for locally crafted or imported items from Thai sellers to keep up. The economics simply don’t favor them.

Pawoot noted that this model creates a flood of low-cost imports that drown out domestic alternatives. And concerns are growing not just about competition but about the quality of these goods (The Star).

The Data Dilemma

As if the pressure on pricing and logistics weren’t enough, TikTok has also started restricting seller access to customer data, citing the Personal Data Protection Act (PDPA). This includes basic information like names, addresses, and contact numbers. Sellers now struggle to build long-term relationships with their buyers because the platform holds all the cards and the contact lists (The Nation).

For many small businesses, that kind of data isn’t just helpful, it’s critical to building trust and retention. Without it, they’re left chasing anonymous clicks.

Is This What a Monopoly Looks Like?

The concern isn’t that TikTok is succeeding, it’s that it’s succeeding too well, too fast, with too little oversight. Pawoot believes this unchecked dominance risks crossing into monopolistic behavior. The signs? Rising service fees, limited seller flexibility, and a heavily tilted playing field in favor of Chinese suppliers and foreign logistics (The Star).

Worse, there seems to be no unified Thai government agency tackling this. Responsibility is fragmented across departments, leaving no clear regulator to protect local interests (The Nation).

So, What Now?

Pawoot has a few suggestions and they’re urgent. First, Thai sellers must diversify. Relying solely on TikTok or any single platform is a business risk. He encourages businesses to invest in their own e-commerce sites, chat support systems, and customer retention strategies that don’t live entirely within one app (The Star).

Second, he calls on regulators to do more than just observe. Agencies like the Electronic Transactions Development Agency (ETDA) and the Trade Competition Commission need to collaborate, strengthen cross-border policies, and tighten import quality controls. Without this, Thailand may become just a digital transit zone, where money flows in briefly, only to flow right back out (The Nation).

The Bigger Picture

TikTok changed a lot. People don’t shop the same way anymore. They don’t even think the same way about what they’re buying or who’s selling it. That kind of influence doesn’t come without consequences.

In Thailand, we have real people running small businesses. They make things, sell things, and try to grow with what they have. But now they’re stuck in a system that keeps shifting the rules. It’s harder to earn, harder to stand out, and harder to survive.

If things keep going this way, we won’t just lose businesses. We’ll lose the people and the culture behind them. That’s not something a platform can replace.

If you care about where the future of commerce, innovation, and digital infrastructure is heading—especially here in Thailand—join us at AWS Manufacturing Day this September. It’s time we talk about solutions that actually work for us.